By Melanie Wiener

Dear Valued Clients and Friends:

The US Small Business Administration (SBA) recently provided Economic Injury Disaster Loan (EIDL) borrowers with information on how to sign up for the new portal in order to effectuate repayment of the loan monies.

Please see below from the SBA and please contact Melanie Wiener at [email protected] or 718-215-5300 x 508 with any questions you may have.

Thank you.

Dear SBA Borrower:

SIGN UP for your SBA CAFS BORROWER LOAN PORTAL NOW to view your upcoming payment due date and payment amount. This is different from the application portal, also known as the RAPID portal, which is closed. As a reminder your SBA COVID-19 Economic Injury Disaster Loan payment is due 30 months from the date of the original Note. Our records indicate your first payment will be due starting October, November, or December 2022.

This is not a forgivable loan. There is no additional deferment at this time.

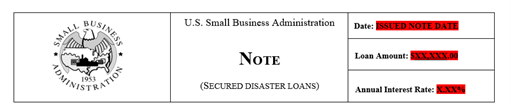

The Note can be found in your original loan closing documents. The date of the Note is located at the top right corner of the front page of the Promissory Note:

During the present 30-month deferment period (if you have not already done so):

- Establish your Borrower loan portal on the SBA Capital Access Financial System (CAFS) at www.sba.gov/pay

- For most business Borrowers – the person whose credit was used in the loan application will be able to access CAFS using their social security number.

- If your business is a sole proprietorship – you will be able to access CAFS using your social security number.

- If your business is a nonprofit or the account is missing a social security number – please email the Disaster Customer Service team at [email protected] on company letterhead to provide the loan number, name, and social security number of the person who should have access. Once complete, a confirmation email will be sent, and that person will be able to establish a CAFS account using the instructions linked above.

- When you received your COVID-19 EIDL on the RAPID portal you agreed to receive electronic billing, so you need to establish your Borrower loan portal.

- During your deferment period, you may make voluntary full or partial payments without prepayment penalties at www.sba.gov/pay. However, you must make your full, regularly scheduled payment beginning 30 months from the date of your Promissory Note as indicated in the first paragraph above.

- Interest has been and will continue to accrue on your loan. If you did not make voluntary payments during the deferment, a final balloon payment will be due on your loan at maturity.

For more information about COVID-19 EIDL loans, please see COVID-19 Economic Injury Disaster Loan (sba.gov). If you have questions or would prefer to authorize a different or additional email address, please email [email protected] or call the SBA Disaster Customer Service team at 833-853-5638.

Sincerely,

U.S. Small Business Administration