New York prohibits employers from making any deductions from wages, except in limited situations. As we advised in a June 2010 client alert, the New York State Labor Department has tightened its enforcement of this statutory provision.

For a deduction to be permissible, the employee must authorize it in writing, and it can only be for “insurance premiums, pension or health and welfare benefits, contributions or payments for United States bonds, payments for dues or assessments to a labor organization and similar payments for the benefit of the employee.”

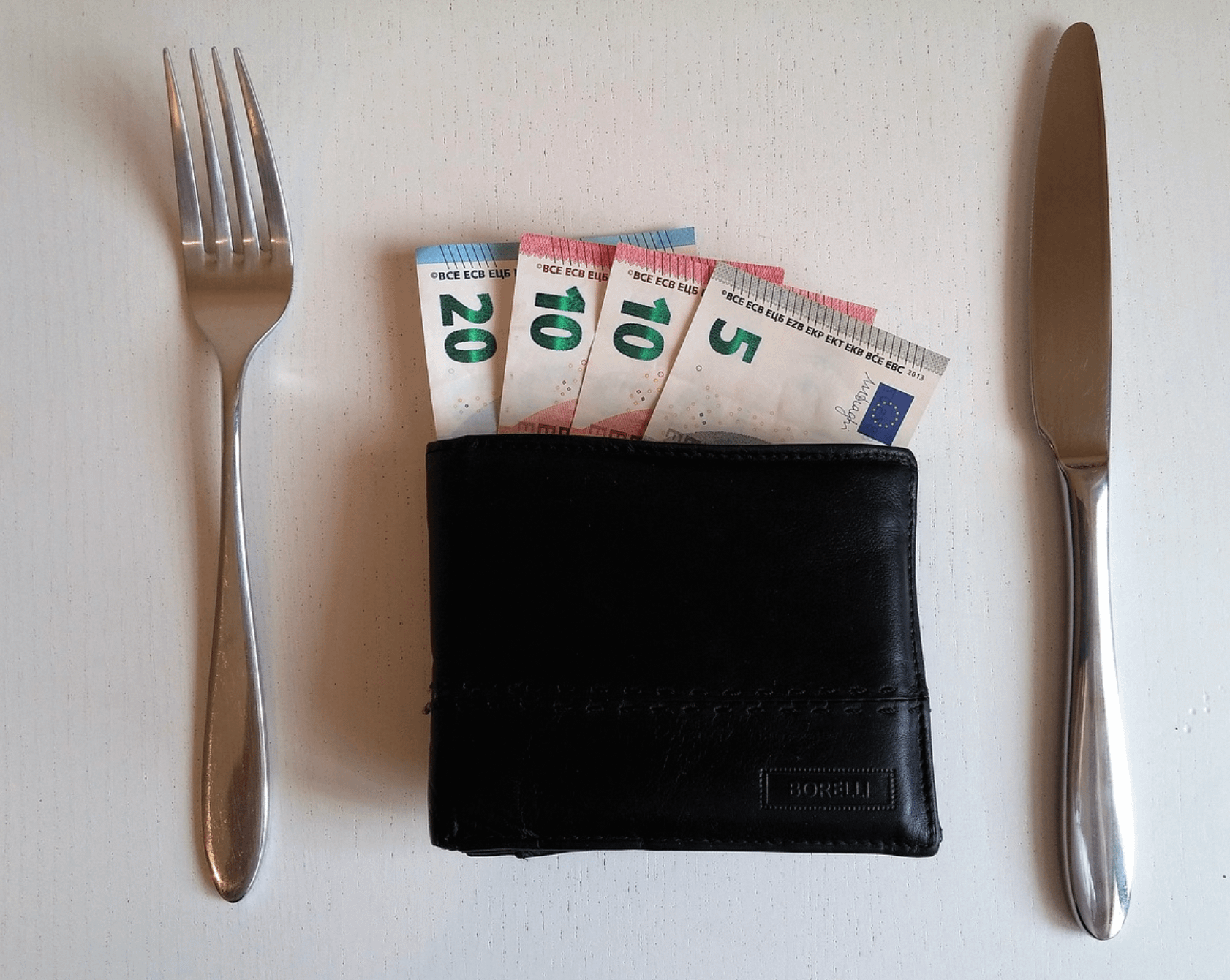

Does that mean that you can give an employee an advance when the employee is in danger of losing his or her house and then recoup it from the employee’s wages? Can an employer pay for meals delivered to the office, and then divvy the cost among the employees by deducting the amount from their wages? Can an employer recoup for lost or damaged equipment by deducting the damages from their wages? The answer to all of these questions has always been an unqualified “no”.

The New York State Labor Department has taken the position that it is impermissible to deduct from an employee’s wages to reimburse the employer for advances taken by the employee, since the reimbursement is for the benefit of the employer (even though the advance is arguably for the benefit of the employee).

In one case decided by New York’s highest court several years ago, a Buffalo employer cashed paychecks for its employees, many of whom did not have their own bank accounts. If the employee wanted the check cashed, the employer performing the cashing service deducted $1 from the employee’s paycheck. The New York State Labor Department’s position that this was a prohibited deduction was upheld.

This policy has led to the anomalous result that employers who wish to help employees by advancing funds for them, or providing other services, decline to do so, because they cannot obtain reimbursement for the advance from the employee’s wages. Many businesses who believed that they were helping an employee have been burnt, when the employee has gone to the Labor Department to obtain reimbursement from the employer for the amounts deducted from their wages.

A bill has been introduced in the New York legislature to change this. A05448 (S 2837) would authorize employers to make deductions from an employee’s wages if the deduction is authorized by the employee and is for the convenience of the employee.

We will be following this bill, and will let you know when or if New York joins the majority of other states by broadening the power of employers to deduct from an employee’s wages. Until then, employers must refrain from making any deductions from employees’ wages not specifically permitted by statute, despite how difficult it might be to deny employees’ requests for advances or other benefits which employees are willing to reimburse from their wages.

* * *

If you have any questions, please contact Sharon P. Stiller at (585) 218-9999